Events

2025 Europe Bank to Bank Forum

Overview

How Resiliency Today Can Help Shape Banking Tomorrow

The banking industry is rapidly evolving amid a multitude of uncontrollable forces – geopolitical pressures, technological advancements, the emergence of new players, and increasing regulatory requirements. At the BAFT Europe Bank to Bank Forum, connect with industry experts to gain insights on navigating these challenges and building resilience today, to shape the future of banking tomorrow.

What to Expect

- More Interactive Sessions: We’ve added an entire afternoon of collaborative sessions, featuring use cases and practical applications on key topics of interest. Some are in-depth sessions, serving as an extension of the morning’s programming.

- Pre-conference Programming included in your registration:

- BAFT Women in Transaction Banking – Europe

- Europe Regional Bank Roundtable (open to banks with asset size under $250B)

- Multiple Networking Opportunities: Dedicated time carved out for bilateral meetings, two evening receptions—including a hosted event at the ING office, the Global Finance Trade Awards, networking lunches, and more.

- Boutique Event with Senior-Level Attendees: The Forum brings together the movers and shakers in the transaction banking industry! If you want to connect with senior transaction banking heads and professionals focused on the European market, this is the event to be at.

Special Room Rate: For your convenience, we’ve reserved a block of rooms especially for conference attendees at the Hilton Amsterdam, the conference venue. Be sure to book early as rooms are limited and only available at this rate until February 14 or until the block is fully booked. Refer to the venue and accommodations page for additional information on room rates.

Program

March 10, 2025

All times are in Central Europe Time (CET)

12:00 - 19:00

Badge Check-in and Registration

12:00 - 14:00

BAFT Women in Transaction Banking - Europe

The Role of Women in Driving Innovation and Financial Inclusion in Transaction Banking

Women are playing a crucial role in transforming transaction banking, driving innovation, and expanding financial inclusion. This panel will bring together leading female professionals in the industry to discuss how their leadership, insights, and initiatives are reshaping global transaction banking.

Moderator

Dean Sposito

Managing Director

Deutsche Bank

Speakers

Elmira Jubanyshkaliyeva

Head of EU FI Cash Sales, Global Transaction Banking

Barclays

Rita King

Managing Director

Lloyds

Vanessa Manning

Managing Director, Head of Transaction Banking

MUFG

14:00 - 16:00

Europe Country Banks Roundtable (invite only)

This special roundtable is open to European banks with asset size of no more than USD$250B. This is an opportunity for similarly-sized banks to engage in open conversations on the most relevant issues and learn from peers.

During the two-hour session, the program will include networking and discussions on the following topics:

- Trade Bank Exchange

- Talent development and current/planned initiatives

- European Country Banks Council

Interested in attending? Please contact [email protected]

16:00 - 17:30

BAFT 2025 Future Leader Program Meeting (invite only)

The agenda for the Future Leaders Program meeting on March 10 includes a 30-minute Future Leaders Council session with introductions and an alumni panel, a presentation by mixed project teams, and a group project session. The meeting aims to foster connections among members and includes alumni, sponsors, BAFT board and Council members.

17:30 - 19:00

Opening Reception

March 11, 2025

All times are in Central Europe Time (CET)

7:30 - 17:00

Badge Check-In and Registration

7:30 - 8:30

Light Morning Treats

Sponsored by

8:30 - 9:00

Welcome Remarks

9:00 - 9:20

Keynote Session

Speaker

Thomas Egner

Secretary General

Euro Banking Association

9:20 - 10:00

Our Changing World – Insights Into a Fragmented World

Trump’s ‘America First’ policies are already impacting global markets, supply chains and relationships. Understanding and adapting to these changes and identifying the risks and opportunities are becoming more difficult. What will the impacts be to the US/China relationship? Will there be a trade deal, or will security challenges upend it? How will Europe react to these new political and economic realities, and how will Trump impact the Middle East and the Russia/Ukraine war? As the ‘new’ world takes shape, Andrew McDougall, Head of Geopolitical Risk, Barclays, and Erik Nielsen, Group Chief Economics Advisor, UniCredit will discuss how this new reality will impact Global Trade and Economic growth.

Speakers

Erik F Nielsen

Group Chief Economics Advisor

UniCredit

Andrew McDougall

Head of Geopolitical Risk

Barclays

10:00 - 10:30

Our Changing World - Weaponisation of Trade - Series 2: 2025

Was Trump 1.0 an aberration or a long-term trend? After a four-year pause, during which we became familiar with industrial policy, sanctions, and export controls as part of our daily trade lives, how will 2025 pan out, and are we on the brink of an all-out economic war? Series 2 starts here.

Speaker

Dr. Rebecca Harding

Independent Trade Economist

Rebeccanomics

10:30 - 10:50

Our Changing World - A Brighter Perspective from a Macroeconomist

Does Peak Pessimism on Europe deserve another look? How do corporates deal with geopolitical uncertainty? Some counterweight to the doom and gloom of geopolitics by a macroeconomist

Marieke Blom

Chief Economist and Global Head of Research

ING

10:50 - 11:15

Networking Coffee Break

Sponsored by

11:15 - 11:35

Global Transaction Banking, Through the Rapids

The Global Transaction Banking business, worth a total of $2.4 trillion continues to grow, faster than GDP, with opportunities shifting from retail to business payments. Digitalization, innovation, and new business models continue to drive opportunities and fundamentals, but rising complexity—shaped by conflicting geopolitical agendas, regulatory priorities, fragmented competition, technology needs and evolving customer expectations—increases challenges for all players. Will success require foresight, focus, or flexibility?

Speaker

Olivier Denecker

Senior Payments Expert

11:35 - 12:20

Instantly Yours – the Now Revolution in Instant Payments and Liquidity

In an era where financial landscapes are rapidly evolving, this panel session will delve into the transformative impact of innovation in transaction banking. With the advent of instant payments and the rise of digital currencies, the industry faces both unprecedented opportunities and challenges. We will explore the diverse landscape of innovative solutions emerging across various regions, highlighting successful case studies and best practices that can be adapted globally. Panelists will discuss the implications of these innovations for transaction banking, particularly in light of G20 requirements aimed at enhancing cross-border payment systems.

Moderator

Christian Kleine

Managing Director, Global Head of Personal & Corporate Banking Operations

UBS

Speakers

Sophia Bantanidis

Future of Finance Analyst

Citi Global Insights

Gauthier Jonckheere

TS EMEA Head of Growth Strategy

BNY

Gloria Wan

General Manager, Liink Kinexys by J.P. Morgan

J.P. Morgan

12:20 - 13:05

Digital Trade Finance: Why Are We Still Waiting?

Accelerating trade finance innovation and digitalization is a topic that keeps coming back despite our best efforts to make lasting progress. Today we have thought leaders covering global banking, regional banking, fintech, and legal to provide perspective on what’s really holding us back.

Facilitator

Mo Allam

Head of Trade Finance Services

ING

Speakers

Frank Aldenhoff

Executive Director, Head Trade Finance FI, Correspondent Banking

LBBW

Gunnar Collin

Director

Enigio AB

Sibel Sirmagul

Managing Director, Global Trade Solutions, Europe CTF & FIG Sales

HSBC

Prof. John Taylor

CCLS, QMUL

Co-founder and Director, CASTL

13:05 - 14:05

Networking Lunch

14:00 - 17:30

Stream A: Collaboration Sessions

14:00 - 14:40

GenAI in Financial Services - Evolution or Potential Revolution?

As GenAI remains a much-discussed topic across the financial services and technology industries, join this panel discussion hosted by Microsoft, together with several of exciting FinTechs who actively use GenAI in partnership with the financial services industry. The panel will bring to life practical use cases of GenAI, discuss what benefits this technology can provide in the near term and their views on future direction.

Moderator

Peter Hazou

Director, Business Development

Microsoft

Speakers

Matthias Verbeke

Co-Founder

Complidata

Stephan Hufnagl

Chief Technology Officer

Traydsteam

Remco DeVries

VP of Demand Generation

Datasnipper

14:40 - 15:25

Roundtable Discussions: Digital Trade Finance: Why Are We Still Waiting?

Building on our earlier session to lay out the key issues holding us back from accelerating toward the digitalization of trade finance, we invite our thought leaders on the topic to facilitate roundtable deep-dives working towards concrete, value-adding use cases and solutions.

Moderator

Jukka Kuusala

Managing Director, Head of Trade Finance

Danske Bank

Facilitators

Frank Aldenhoff

Executive Director, Head Trade Finance FI, Correspondent Banking

LBBW

Gunnar Collin

Director

Enigio AB

Sibel Sirmagul

Managing Director, Global Trade Solutions, Europe CTF & FIG Sales

HSBC

Prof. John Taylor

CCLS, QMUL

Co-founder and Director, CASTL

15:25 - 15:40

Networking Coffee Break

Sponsored by

15:40 - 16:00

Platforms: Their Importance and the Benefits They Bring to Correspondent Banking

Like many aspects of Banking, the Agent and Correspondent Bank arena are full of detail and fraught with difficulty. This Panel will discuss some of the challenges faced and what the future might hold for technology-driven solutions like Platforms - which touch on relationship management, running RFPs, document management, cost control and fee capture, as well as due diligence and reporting - and TPRM generally.

Speaker

Paul Jamael

MD & Head Global Banks Coverage & CB

CIBC

Simon Shepherd

Managing Director

MYRIAD Group Technologies

16:00 - 16:40

ISO 20022 as an Agent for Payment Innovation

This November ISO 20022 MX payment messages will become the sole standard on the Swift Network, fully replacing MT payment messages. This panel session will explore the progress and learnings to date of the extended ISO 20022 Swift migration and explore some of the benefits the industry is already seeing. Most importantly the panel will also explore how the new standards can enhance our client payment journeys as well as additional opportunities for payment innovation.

Moderator

Oonagh McGrane

Lloyds

Speakers

Esther Galiana

Global Head of Cross Border Payments and Cash Management Solutions

BBVA

Jeremy McDougall

Director, Payments

EY

Dominik Vogel

Executive Director, Product Owner Instant, Payments Transformation

UBS

16:40 - 17:00

Navigating the Complexities of Cross-Border FX Payments in Exotic Currencies: Opportunities for European Corporates and Banks

Explore the challenges and opportunities in handling cross-border payments in exotic currencies, with insights on regulatory hurdles, currency controls, and managing settlement risks.

Speaker

David Willacy

Head of Trading EMEA – Payments FX

StoneX

17:00 - 17:30

Understanding Key Changes to the 2025 BAFT Master Trade Loan Agreement (MTLA)

Explore the latest updates to the BAFT Master Trade Loan Agreement (MTLA). Developed by a working group of BAFT member experts in collaboration with legal counsel from Sullivan & Worcester UK LLP, the 2025 MTLA reflects significant developments in market practice and major shifts in the global regulatory landscape. Geoffrey Wynne of Sullivan & Worcester will guide us through these changes and their benefits for the industry.

Interviewer

Deepesh Patel

Editorial Director

Trade Finance Global

Speaker

Geoffrey Wynne

Partner

Sullivan and Worcester UK LLP

14:00 - 17:30

Steam B: Bilateral Meetings

18:00 - 19:30

Evening Reception Offsite Hosted by ING

Evening Reception Hosted Offsite by ING at:

CEDAR Building A, Bijlmerdreef 106

1102 CT

Amsterdam

Please meet in the Ballroom Foyer, buses will be begin leaving at 5:45PM. After 6pm – guests can take a taxi/uber to the ING office. Buses will leave the ING Building beginning at 7:30 PM and return to the Hotel

Hosted by

March 12, 2025

All times are in Central Europe Time (CET)

8:00 - 12:00

Badge Check-in and Registration

9:00 - 9:05

Welcome Day 2

9:05 - 9:25

Keynote Session: Collaborating For a Better Payments Ecosystem

The financial community is engaging in critical work to address fragmentation, increase interoperability, and progress towards instant and frictionless cross-border transactions. Marianne Demarchi, Swift’s chief executive EMEA, highlights the progress made and the work that’s still to be done, to futureproof the financial ecosystem and enhance the customer experience.

Marianne Demarchi

Chief Executive EMEA

Swift

9:25 - 10:00

Turning Data into Commercial Products

How Banks can commercialise and productionalize the huge amount of data available to them and turn it into insight for clients

Interviewer

Deepesh Patel

Editorial Director

Trade Finance Global

Speaker

Matthew Burns

Managing Director, Transaction Banking Solutions

Lloyds

10:00 - 10:40

Does an Ideal Operational Model Exist for Correspondent Banking?

G20 objectives trigger an unprecedented pressure on the correspondent banking industry to lower their prices and consequently their costs to operate. Indeed, this has become an almost existential matter for a banking business struggling with both fragmentation and disruption. A cohort of BAFT Future Leaders is currently trying to answer this challenging question: does an ideal operational model exist for correspondent banking? To help them (and us at the same time), why don’t we start by listening to one of our industry’s leading Institutions. Leaders are not always right but at least all of them are very good sources of inspiration.

Speakers

Jean Francois Mazure

Head of Cash Clearing Services

Societe Generale

Elena Hergass

Global Co-Head of Corporate Bank Operations & Hub Head Berlin CoE

Deutsche Bank

10:40 - 11:10

Bridging the Generational Gap

An experienced banker and a younger professional go head-to-head, exploring the intersection of tradition and innovation in transaction banking. From digital transformation to shifting client priorities and the rise of the word no, they will share contrasting perspectives on navigating change and driving progress in transaction banking. Join the discussion and discover how collaboration across generations is shaping the future of the industry

Moderator

Bana Azhari

Managing Director

BNY

Speaker

Daranee Bolger

Vice President – Transaction Banking, Financial Institutions

NatWest

Keith J. Wright

Managing Director, Global Financial Institutions

Bank of America

11:10 - 11:40

Networking Break

Sponsored by

11:40 - 12:25

The Evolving Financial Crime Landscape

A diverse panel from across the financial services industry will discuss and debate the key risks, priorities and concerns across the complex cross-border payments universe relative to Financial Crime. The panel will delve into the major issues around sanctions, including the different approaches and challenges this creates for players across the industry.

Moderator

Ed Thurman

Chief Commercial Officer

Global Screening Services

Speakers

Patrick Green

Head of AML & UK MLRO

Banking Circle SA

Sandrine Lac

Head of Business Management Office – Cash Clearing

Societe Generale

Nick Senechal

Strategist and Consultant, Real-Time Payments

Visa

12:25 - 13:10

Transaction Banking Global Leaders - A View from the Top

This session will provide a unique opportunity to hear from three Global Heads of Transaction Banking from leading European Financial Institutions, all with a global footprint. We will explore how the Transaction Banking business is viewed from the Top of the House in these respective institutions and delve into the current landscape confronting the overall transaction banking industry. Opportunities and challenges will be highlighted, and we will open the floor for questions to cap off what will certainly be an interesting exchange.

Moderator

Dean Sposito

Managing Director

Deutsche Bank

Panelists

Elvira Kruger

Head of Global Transaction Banking

ING

Eva Rubio

Head of Global Transaction Banking

BBVA

13:00 - 13:15

Wrap Up and Closing Remarks

13:15 - 15:00

Global Finance Awards and Networking Lunch

Sponsored by

15:30 - Onwards

Women in Transaction Banking Informal Gathering

Join us for a conversation, excellent company, and (buy your own) drink post-conference!

All attendees are welcome.

Venue: Half Moon Lounge of the Hilton Amsterdam

Speakers

Monday, March 10, 2025

Elmira Jubanyshkaliyeva is Head of EU FI Cash Sales for Barclays Europe based in Amsterdam. With over 20 years of payments and cash management experience across financial services, Elmira leads a team of cash sales professionals specialised in Financial Institutions covering banks, fintechs, broker-dealers and specialist finance entities. Elmira has been with Barclays for 6 years and is responsible for delivering on Barclays Europe’s growth ambition. Prior to that, Elmira held senior product management positions at Worldline, RBS and ABN AMRO Bank as part of Transaction Banking, where she designed products and services fulfilling the needs of FI clients. Earlier in her career as a management consultant at KPMG, Elmira advised clients on strategic topics related to operational risk management and operational excellence.

Rita is the Head of Institutional Trade Sales at Lloyds Bank, which includes responsibility for Global Banks and Non-Bank FI sectors. Her team provide bespoke trade solutions, supporting with risk management and working capital, with a strong focus on assisting exporters in expanding their international trade activities. Prior to specialising in Trade, Rita held Coverage roles in London and New York, since joining Lloyds in 2007. Rita holds a degree in Law and a First Class Masters in Management Studies. She sits on BAFT’s Women in Transaction Banking council and a member of Women in Banking + Finance. Rita has been a mentor to colleagues across talent programmes and is passionate about supporting others with career development.

Vanessa Manning will be responsible for driving further profitable growth across MUFG's Transaction Banking business in EMEA, as well as overseeing the strategic development of the Trade and Working Capital and Cash and Liquidity Management functions. With over 22 years' leadership experience in Global Cash & Trade Management gained from ABN AMRO, RBS, Standard Chartered and Deutsche Bank, Ms Manning is also an active member of institutional Diversity and Inclusion initiatives, including UK and European Women in Payments, and is a motivated mentor and mentee within the European Techstar Rise community.

Dean Sposito is Head of Institutional Cash and Trade, Western Europe, based in Frankfurt. Dean carries management responsibility for teams in eight locations throughout Europe. In this region, Deutsche Bank has active Cash Management and Trade Finance relationships with Financial Institutions in over 30 countries and maintains leading positions in EUR, USD, and other major currencies. Deutsche Bank is a premier provider of Cash Management and Trade Finance services to Financial Institutions globally. Deutsche Bank is a recognized leader among its peers, helping clients to efficiently manage their payments and trade needs across multiple time zones, borders and currencies.

Tuesday, March 11. 2025

Frank Aldenhoff joined LBBW in January 2025 to further grow the bank’s global trade finance business. Prior to joining LBBW, he was Head of ESG Coverage for MNC clients at Deutsche Bank driving sustainable finance transactions and solutions for about 2 years. Before that, he was more than 10 years Regional Head FI Trade Finance and most recently in parallel Head of Trade Finance Corporate Desk. Frank is a career-long transaction banker with extensive experience in trade finance and cash management. He has covered FI clients in Europe and Central Asia, East & Southern Africa, as well as Latin America. Frank holds a M.Sc. degree in Economics and certification as expert in sustainable finance from FS-UNEP.

Sophia Bantanidis is an Analyst in the Future of Finance team within Citi Global Insights covering digital assets and FinTech and how they will shape the future of financial services. She joined Citi in 2016 as the Head of Regulatory Strategy and Policy for Innovation and has held various positions at 2 financial services regulators in the UK and France (the FCA and La Commission Bancaire in Paris), numerous banks and an asset management firm. In April 2021 she was awarded Greek International Woman of the Year in Finance and is on the Women in FinTech Powerlist for 5 consecutive years. She enjoys mentoring start-ups and is on the advisory board of Nifty World NFT (a non-fungible token business) and P.S. Online Styling (digital fashion) both female led start-ups.

Marieke Blom has been chief economist at ING in the Netherlands since 2014. Her Research team in Amsterdam analyses a broad range of economic issues: from monetary policy and the Dutch housing market to developments in specific sectors, sustainability and technology. Marieke is a member of the board of the Royal Netherlands Economic Association (Koninklijke Vereniging voor de Staatshuishoudkunde, KVS) – the oldest association of economists in the world. She is also a member of the independent advisory committee of the National Growth Fund (Nationaal Groeifonds). She regularly appears in the media. Before joining ING, Marieke worked as a senior manager at ’De Argumentenfabriek’ in Amsterdam. Prior to that, she was a political adviser to the Dutch Labour Party (PvdA). She started her career as a trainee and economist at ABN Amro in 1999.

Gunnar Collin is a seasoned operations and sales professional with extensive experience in the financial and technology sectors, gained through working with diverse organizations across various geographies and cultural environments. The digitalization of trade finance presents unique challenges and opportunities. It requires seamless collaboration across geographies, alignment among a wide range of parties and stakeholders, adherence to universal legal frameworks and rules, and the adoption of practical, effective technical solutions. Enigio’s trace:original solution for electronic documents has made this transformation feasible, offering innovative capabilities to meet these demands. This is where Gunnar Collin’s full professional focus lies—leveraging expertise to support organizations in navigating the complexities of trade finance digitalization and delivering sustainable, forward-looking solutions.

Thomas Egner is Secretary General of the Euro Banking Association (EBA). He has been holding this position since 1st May 2016. Thomas Egner has been engaged in transaction banking for over 20 years, most recently at Commerzbank, where he was responsible for defining and developing clearing and settlement strategies, mainly in the sector of mass payments. He was a member of the bank’s SEPA Program Management Team and closely involved in the implementation of the Payment Services Directive (PSD) within Commerzbank. Representing his institution in the European Payments Council and the German banking community in SWIFT and ISO committees, Thomas Egner has helped to shape the European payments landscape over the last 15 years. Thomas also served as a Board member of EBA CLEARING from 2004 to 2015 and contributed to different national payment committees in Germany.

Esther Galiana is the Global Head of Financial Institutions at BBVA. She is also involved in BBVA´s agenda regarding transformation and sustainability. Ms. Galiana has extensive corporate & investment banking experience combined with corporate experience in the health care sector. Additionally, she has been active in strategy and business development at BBVA e-commerce and BBVA Wholesale Banking & Asset Management. Prior to BBVA, she worked with Santander New York in Structured Trade Finance. Earlier in her career, Ms. Galiana worked at the Federal Reserve Bank of Boston in banking supervision. She has been Vice Chair of BAFT and co-chair of the BAFT Europe Council. Ms. Galiana is also a professor at the Masters in Banking and Financial Regulation of the University of Navarra.

Dr. Rebecca Harding is CEO of the Centre for Economic Security, a Senior Fellow of the British Foreign Policy Group, an Associate at Earendel Associates, an independent trade economist and strategic adviser to financial services organisations, and a public speaker. She has built three data-based technology businesses, and in 2022 was awarded the Scale Up Group’s “Net Zero Entrepreneur of the Year” Award. She has held senior positions as Head of Corporate Research at Deloitte, Senior Fellow at London Business School, and Chief Economist roles at the Work Foundation and at UK Finance. She acted as Specialist Adviser to the Treasury Select Committee and advised the All-Party Parliamentary Group on Entrepreneurship. She is an associate Partner of the T3i network, and a member of the World Trade Board, and the ICC’s sustainable trade “Eco-terms” working group. She co-chairs the ITFA’s ESG Audit Council. Between 2004 and 2018 she was a Director and Trustee of the German-British Forum.

Peter Hazou is Director of Business Development at Microsoft in the Financial Services Industry team and is responsible for client Corporate Banking and Trade Finance solutions and modernization worldwide. Prior to Microsoft, Peter was a Transaction Banking industry banker for 30+ years in the EMEA region. He was the Regional Head for GTB at HSBC for EMEA as well as the Regional Head for GTS at Citigroup for CEEMEA. He also headed Market Management for Treasury Services at BNY Mellon in London and was Head of Strategy for GTB at UniCredit in Milan. His background is in Product Management for Payments at Chase Manhattan Bank. He began his career in New York as a credit officer in correspondent banking at Manufacturers Hanover Trust.

Stephan Hufnagl is the CTO at Traydstream, spearheading the company's technological advancements and driving innovation in trade finance solutions. Traydstream is a pioneer in trade finance technology, revolutionizing the processing of trade finance documents with its AI-driven platform and leveraging advanced analytics to extract valuable insights from vast amounts of trade data. Stephan brings a wealth of experience from his tenure at Microsoft, Google, and other engineering companies. At Microsoft, he led Data, Analytics, and AI teams, driving transformative projects with cloud services. Additionally, he developed tailored industry solutions in his own business, which he successfully sold.

Paul Jamael is a Managing Director and Head, Global Banks Coverage and Correspondent Banking at CIBC based in Toronto, Ontario. Previously, Paul was a Head Executive Director, Correspondent Banking & Portfolio Risk Management at CIBC and also held positions at BMO.

Jukka Kuusala is an experienced banking professional currently serving as SVP - Global Head of Trade Finance and Head of Trade Finance Finland at Danske Bank since July 2022. Prior to this role, Jukka worked at Handelsbanken from February 2010 to July 2022, where responsibilities included heading Trade & Export Finance & Cash Management Sales and Corporate Banking. Jukka's career also includes a position as Assistant Vice President of Trade Finance at Nordea Bank Finland Plc from October 2007 to February 2010 and a Senior Specialist in Documentary Credits at Stora Enso from April 2003 to October 2007. Jukka has a strong background in export and import trade finance, focusing on documentary credits, guarantees, collections, and export finance, as well as managing bank and country risks in financing. Jukka holds a degree from the University of Northampton.

Andrew McDougall is Group Head of Geopolitical Risk for Barclays and advises Barclays Board and executive leadership on global affairs. He joined Barclays from the UK Foreign Office, where he gained extensive experience working on some of the most important global issues over the past two decades. His particular expertise is Europe, Russia, and China, but also worked closely on Iran and South Asia (India/Pakistan/Afghanistan) earlier in his career. Andrew’s final posting was in Brussels (Political Counsellor in the UK Mission to the EU and NATO) but also served in Switzerland, India, and the Middle East. As a British Army officer, he served in Northern Ireland, the Balkans, and Iraq, before joining the Foreign Office. He read Law and International Relations at university.

Jeremy is a Director in the EY UK Payments team, specialising in cross border payments and ISO 20022. He has significant experience in Financial Services having worked with the leading global banks and networks. He has helped clients with large and complex payments programs including Structural Reform, Brexit and the Swift ISO 20022 Cross Border Payments and Reporting (CBPR+). Jeremy is passionate about building diverse teams and creating an inclusive environment in the ever-changing payments industry.

Oonagh is responsible for the commercialisation of the Lloyds Bank Payables and Receivables proposition for Financial Institutions, covering indirect participants and correspondent banking for Commercial Banking FI Clients and that Lloyds Bank has the coverage needed to service the international Payments & Trade needs of Lloyds Bank Customers, setting the Network strategy, identifying partners, future international payments roadmap & managing a Network of international banking partners. Oonagh is a Global Transaction Banking professional with over 25 years’ experience in the field of Cash Management & Payments. Prior to joining Lloyds Bank in December 2015, she worked for ABN AMRO, RBS and Citi covering a variety of roles in Operations, Client Service, Product and Account Management. Oonagh holds a B.A. (Hons) Degree in Applied Languages from Dublin City University and is a certified Professional Scrum Master.

Erik Fossing Nielsen is Group Chief Economist and Global Head of CIB Research at Unicredit. In these roles, Erik is responsible for forming and communicating the independent research views on macroeconomic and policy issues, markets and asset allocation, under the UniCredit banner. Prior to joining UniCredit in September 2011, Erik worked for fifteen years as an economist at Goldman Sachs in New York and London, where his most recent role was Chief European Economist overseeing the European and CEE economics teams. Before joining Goldman he spent ten years in Washington DC working as an economist for the IMF and World Bank in various capacities, including as country economist for Russia and Turkey, and as a debt expert working on sovereign debt workouts around the world. Erik is one of the most frequently quoted economists in the financial media, and appears regularly as guest host and commentator on Bloomberg TV, CNBC, CNN and other channels.

Deepesh Patel is Editor-in-Chief at Trade Finance Global (TFG). In this role, Deepesh leads efforts in developing TFG’s editorial and research strategy in key markets, including the UK, US, Singapore, Dubai and Hong Kong. Deepesh regularly chairs and speaks at industry events covering trade, treasury and payments, including The Economist, Reuters, UN, WEF and WTO, as well as industry associations including BAFT, FCI, ICC, ICISA and ITFA. Deepesh hosts the popular ‘Trade Finance Talks’ podcast and TV station, with a combined 300+ episodes and 50k+ followers. He is co-author of ‘Blockchain for Trade: A Reality Check’ and ‘Accelerating Trade Digitalization to Support MSME Financing’ with the ICC and the WTO, alongside other industry research. Deepesh is an advocate for promoting diversity, equity and inclusion (DEI) within the industry, founding the Women in Trade, Treasury and Payments initiative in 2019. In addition to his work at TFG, Deepesh is a Strategic Advisor for WOA, and is a Member of the ITFA ESG Committee. He also sits on the Fintech Working Group of the Standardised Trust. Prior to TFG, Deepesh worked at Travelex where he was responsible for the cards business and the Travelex Money app in Brazil, Europe, US and UK. Deepesh is Chair of Governors and co-opted LA Governor of the Wyvern Federation, which has responsibility for 5 primary schools in South London.

Simon is based in London and travels extensively for the Company. As Managing Director Simon oversees Board-level activity and all matters ‘Corporate’. Simon has been with the Company since inception in August 2004. His role is predominantly taking our product suite to market, supporting Sales and Marketing and all-round Business Development, as well as working closely with the CEO as we continue to grow the Company.

Sibel Sirmagul is the UK Head of Sales for HSBC’s Global Trade Solutions, supporting clients with working capital and structured trade solutions, and helping to transition their supply chains. Sibel works closely with businesses as strategic partner to help them grow globally and navigate an ever-changing landscape through innovative solutions. She started her career with ABN AMRO Bank in 2000, holding senior structured lending positions across various regions; Europe, Middle East and North America. In 2010, following the acquisition by RBS, she joined the Trade Advisory team where she successfully led the structured trade solutions including supply chain, receivables finance throughout Europe and the Middle East.Sibel holds an MBA from London Business School and is a CFA® charterholder.’’

John Taylor specializes in international law, finance, trade and corporate governance. He is a director of the Centre for Applied Sustainable Transition Law (CASTL) and an Honorary Professor at Queen Mary University of London. He advises banks and other clients on cross-border sustainablility, financial regulation and international business opportunities. He has held legal and banking positions in the Asian Development Bank, the World Bank and EBRD, where he was General Counsel. His other experience has been in law firms in Australia, the US and the UK and in an international investment bank, a private equity firm and a large fund management group. He is an Honorary Member of BAFT and has been a member of BAFT’s Europe Council since 2010.

Mr. MATTHIAS VERBEKE is a RegTech leader and CEO of Complidata, an emerging regtech start-up which focuses on A.I.-driven Process Automation Solutions for Compliance. Its key solutions include: Trade Finance Risk Monitoring, AML Optimisation and Corporate KYC Automation. Known for its fully configurable, regulatory compliant and explainable A.I.-driven solutions, Complidata was recently awarded with “Best A.I. Start-up of the Year” at Disummit, Belgium.

Dominik Vogel is Executive Director in the COO division of Personal & Corporate Clients of UBS Switzerland AG. In his role as Lead Product Owner, he drives the global Instant Payments Transformation & Payments Modernization initiative. He is also overseeing the UBS internal ISO 20022 adoption program covering multiple ISO migration initiatives such as MX/CBPR+, MEPS+/SCRIPS, CHATS, FED & CHIPS. Dominik joined UBS in 2002 and has been involved in several projects, such as the implementation of Swift GPI, adoption of ISO 20022 in Switzerland, data analytics projects and global payments infrastructure programs. He is a board member of the Swiss Association for Swift and Financial Standards (SASFS), the Payments Committee Switzerland (PaCoS) and represents the Swiss Community in the Payments Market Practice Group (PMPG).

Gloria is the General Manager of Confirm (Global Account Validation) and Route Logic (FX Routing Intelligence) applications for Kinexys Liink network. Kinexys Liink is a scalable, permission based, peer-to-peer blockchain network that uses privacy-preserving technology for secure, information and capability exchange. As a General Manager, Gloria oversees product development, client success, and commercial growth for the Confirm and Route Logic applications. She has worked closely with Financial Institutions, Fintechs, and Corporates to reduce the risk of payment returns and fraud through data exchange. Prior to joining Kinexys by J.P. Morgan, Gloria worked as a product manager in Securities Services driving product strategy, innovative solutions and business expansion for the Global Custody business. She had experience covering a range of buyside institution investors, including asset manager, insurance, pensions, and hedge funds. While working in Global Custody, she also participated in internal and industry working groups to analyse the market trends and product design for digital assets custody.

Geoffrey Wynne is Head of Sullivan & Worcester’s London office and its Trade and Export Finance Group. A leading trade finance lawyer, he specialises in trade, structured trade and commodity finance, advising major banks, non-bank financial institutions and multilaterals on transactions in emerging markets. Geoff’s expertise includes digitalisation of trade, warehouse and inventory financing, collateral management, ownership structures and receivables financing. He works with industry bodies including BAFT, ITFA, and the ICC, advising them on documentation and rules promulgated by them in trade finance. Geoff co-chaired the ICC Drafting Committee for the Uniform Rules for Digital Trade Transactions (URDTT) and was involved in the Electronic Trade Documents Act (2023). Recognised with a Lifetime Achievement Award by RFIx in 2024, he is top ranked by Chambers UK (for which he is singled out as a ‘Star Individual’), the UK Legal 500 and IFLR1000. The team he leads has won numerous awards, including ‘Legal Innovation in Trade’ (TFG, 2023) and Best Export Finance Law Firm (GTR, 2023). Geoff is the editor of ‘The Practitioner’s Guide to Trade and Commodity Finance’ and General Editor of ‘A Guide to Receivables Finance’.

Wednesday, March 12, 2025

Bana Akkad Azhari is Head of Treasury Services – Europe, Middle East & Africa (EMEA) for BNY Mellon. She is responsible for the overall coverage and delivery of BNY Mellon’s products and services to existing and potential clients as well as market development and strategic growth opportunities in Payments, Trade and liquidity solutions. Based in London where she relocated in 2021 after leading Treasury Services Relationship Management and Business Development in the Middle East, Africa and Commonwealth of Independent States (MEA – CIS) region, Bana joined BNY Mellon in 2006 as Chief Representative with overall responsibility for the Bank's business in Lebanon. Prior to joining BNY Mellon, Bana worked for over nine years with Citigroup in Beirut where she held the position of Resident Vice President and was a member of the credit committee. She moved across various roles in the organization, the last of which was the position of relationship manager for financial institutions, branches of multinational corporations, and NGOs. Prior to that, she held various positions in Credit Administration and Treasury.

Marianne Demarchi has more than 25 years’ experience in financial and banking services across fintechs and major international corporations. She has had increasing responsibilities in business development, digital transformation, and company management. In 2022, she joined Swift as Head of European Strategic Accounts, and was subsequently appointed Chief Executive Europe in December 2022, covering Business Development across the region. In January 2024, she expanded her role to cover the Middle East and Africa. From 2017 to 2021, Marianne was COO and member of the Board of Monext, a payments fintech and subsidiary of Credit Mutuel Arkea Bank. She previously worked at BNP Paribas Asset Management as Global Head of Sales and Strategic Partnerships, having also worked as Deputy Head of Marketing. From 2008 to 2021 she served on the Distribution Executive Committee. Prior to this she spent 15 years at Euronext in various roles, supporting the transformation of the Paris stock exchange into a pan-European stock exchange.

Patrick Green is currently the Global Head of AML and UK MLRO at Banking Circle, overseeing the Client Due Diligence, Transaction Monitoring, Intelligence & Investigations and Sanctions teams to ensure effective, client-focused onboarding and monitoring globally. Patrick joined Banking Circle as Head of Client Onboarding in 2020 and brings more than 15 years’ experience within the FI and NBFI sectors and is leading an initiative to digitize and enhance the onboarding, and ongoing monitoring, approach to Banking Circle’s clients globally. Banking Circle are a credit institution, regulated by the CSSF, UK FCA and BaFin, focused on enhancing the correspondent banking payment infrastructure both in fiat and, most recently, through the launch of the first Bank-issued MICA regulated Stablecoin (Euro) in 2024. Prior to joining Banking Circle, Patrick spent 14 years at Barclays in London including roles across the FI, Global Corporate and Non-Bank FI verticals within 1LOD AML, Relationship Management and Cash Management.

Elena Hergass is the global Co-Head of Corporate Bank Operations and Site Lead of the Deutsche Bank’s Delivery Hub in Berlin. She has been with DB for 25 years and has been successfully delivering in multiple global roles within Trade Finance & Lending Product Management, Client Advisory and Service and recently as Head of Cash, Surveillance and Messaging Operations. She is member of the Corporate Bank ExCo and the Corporate and Investment Bank Operations and Controls Leadership Team.

Elvira is a banking executive with over 20 years of experience across multiple sectors, products, and geographies. In her current role with ING she leads an organisation of Transaction Services professionals across a global network of 27 countries. Elvira is a member of ING’s Wholesale Banking Management Team. She holds a non-executive position on the SWIFT board of directors. Elvira has a Bachelor’s degree in Business Administration from Denver University and a Master of International Management from the Thunderbird School of Global Management.

After graduating from Toulouse Capitole University and IAE Aix-Marseille with a master’s degree in Management, and in Internal Audit, Sandrine Lac started her career as an auditor at S.G.F.G.A.S. (Société de Gestion du Fonds de Garantie de l’Accession) in 1997. In 1999, she joined HSBC France where she successively held the positions of Audit Manager, Compliance Officer and Business Risk and Control Manager. In 2015, she joined Societe Generale Group as Sanctions Compliance Officer. In 2020, she was appointed Wholesale Banking Head of Sanctions for Societe Generale Group. In 2024, she was appointed Head of Business Management Office for Correspondent Banking activities.

Graduated from the ESCEM Tours and the University of Ottawa, Jean-François joined Société Générale in 1993. He held various managerial positions in the French retail network, essentially on the SME and large corporate segments. In 2011, he was appointed Senior Banker on a portfolio of key agribusiness corporate clients, most of them belonging to the cooperative sector. In November 2015, he joined GTB division as co-Head of Cash Clearing Services, before being appointed Head of the same business line one year later.

Eva Rubio is Managing Director and Head of Global Transaction Banking at BBVA. She has been working in different positions within CIB. She was leading the Equity Research Analysts team covering European Banks and Insurance companies for 10 years. From 2006 to 2012 she was leading the Global Markets Strategy and Business development team. From 2011 to 2019 she was leading CIB Finance, Global Planning and Talent and Culture department.

Nick Senechal is a Strategic Advisor to Visa Direct. In this role he is working on a number of growth initiatives to build the money movement business, with special focus on cross border collaboration, fincrime prevention, connectivity to domestic payment networks and innovative settlement approaches. Nick also represents Visa on multiple industry bodies and working groups within the CPMI, UK Finance, EPSG and EPC. At Visa, Nick also led strategy work in open banking and real-time payments. Prior to Visa, Nick had over 30 years' experience payments with Vocalink and its predecessors. Notable achievements include leading the business architecture for the re-platforming of the UK retail infrastructure, which in turn led to developing the concept for “Faser Payments” and real time payments globally, as well as a range of value-added services.

Dean Sposito is Head of Institutional Cash and Trade, Western Europe, based in Frankfurt. Dean carries management responsibility for teams in eight locations throughout Europe. In this region, Deutsche Bank has active Cash Management and Trade Finance relationships with Financial Institutions in over 30 countries and maintains leading positions in EUR, USD, and other major currencies. Deutsche Bank is a premier provider of Cash Management and Trade Finance services to Financial Institutions globally. Deutsche Bank is a recognized leader among its peers, helping clients to efficiently manage their payments and trade needs across multiple time zones, borders and currencies.

Edward Thurman is the Chief Commercial Officer at GSS – Global Screening Services and has over 25 years of experience in the financial services industry as a regulator, consultant and in senior management roles within financial institutions. He recently served as Managing Director, Global Transaction Banking and Managing Director, Financial Institutions at Lloyds Banking Group, and prior to that in senior strategy roles at ABN AMRO, McKinsey and Bank of England. Edward is also a Global Board Member for Mind Forward Alliance a global not-for-profit membership organisation.

FAQ's

Sponsorship

Connect with Transaction Bankers in Europe

BAFT’s annual Europe Bank to Bank Forum is tailored specifically for transaction banking executives, practitioners, and professionals involved in the trade and payments industries. Our focus is on education and thought leadership, exploring the key issues that drive the growth and impact of transaction banking, specifically within the European market.

Get Your Brand in Front of Your Target Audience

This conference draws 300+ transaction banking, cash/treasury, trade, international banking and innovation executives and professionals from over 100 banking institutions, government agencies, fintech firms, and other providers and corporations.

Premier Levels

Platinum Sponsor – SOLD OUT

- Speaking opportunity in the conference program (subject to planning committee approval)

- 4 complimentary conference registrations

- Bi-lateral meeting space and table-top display (sponsor provides branded tablecloth)

- Pull-up banner in registration area (sponsor provides banner)

- One-page flyer for conference registration desk

- Recognition as Platinum Sponsor during event opening and logo displayed on event PowerPoint slide

- Logo included on conference website, registration page and confirmation email

- Logo included on all email promotion pre- and post-event

- Registration list with contact details (name, company, title, email) pre- and post-event

Gold Sponsor – SOLD OUT

- Speaking opportunity in the conference program (subject to planning committee approval)

- 3 complimentary conference registrations

- Option to add bi-lateral meeting space for additional $1000

- Table-top display (sponsor provides branded tablecloth)

- Pull-up banner in registration area (sponsor provides banner)

- One-page flyer for conference registration desk

- Recognition as Gold Sponsor during event opening and logo displayed on event PowerPoint slide

- Logo included on conference website, registration page and confirmation email

- Logo included on all email promotion pre- and post-event

- Registration list with contact details (name, company, title, email) pre- and post-event

Silver Sponsor – 2 Available

- 2 complimentary conference registrations

- Pull-up banner in registration area (sponsor provides banner)

- Option to add bi-lateral meeting space for additional $2000

- One-page flyer for conference registration desk

- Recognition as Silver Sponsor during event opening and logo displayed on event PowerPoint slide

- Logo included on conference website, registration page and confirmation email

- Logo included on all email promotion pre- and post-event

- Registration list with contact details (name, company, title, email) pre- and post-event

Featured Events Sponsorship

Opening Welcome Reception – 1 Available

- Sponsor provides welcome remarks at the Monday Evening Reception

- 3 complimentary conference registrations

- Table-top display (sponsor provides branded tablecloth)

- Pull-up banner at Evening Reception (sponsor provides banner)

- One-page flyer for conference registration desk

- Recognition as Sponsor during event opening and logo displayed on event PowerPoint slide

- Logo included on conference website, registration page and confirmation email

- Logo included on all email promotion pre- and post-event

- Registration list with contact details (name, company, title, email) pre- and post-event

Tuesday Evening Reception – SOLD OUT

- Sponsor provides welcome remarks at the Tuesday Evening Reception

- 2 complimentary conference registrations

- Table-top display (sponsor provides branded tablecloth)

- Pull-up banner at Evening Reception (sponsor provides banner)

- One-page flyer for conference registration desk

- Recognition as Sponsor during event opening and logo displayed on event PowerPoint slide

- Logo included on conference website, registration page and confirmation email

- Logo included on all email promotion pre- and post-event

- Registration list with contact details (name, company, title, email) pre- and post-event

Networking Lunch – 1 Available

- Sponsor provides welcome remarks at the Networking Lunch (Tuesday)

- 2 complimentary conference registrations

- Pull-up banner at Networking Lunch (sponsor provides banner)

- One-page flyer for conference registration desk

- Recognition as Sponsor during event opening and logo displayed on event PowerPoint slide

- Logo included on conference website, registration page and confirmation email

- Logo included on all email promotion pre- and post-event

- Registration list with contact details (name, company, title, email) pre- and post-event

Networking Breakfast – 2 Available

- Sponsor provides welcome remarks at the Networking Breakfast (Tuesday or Wednesday)

- 1 complimentary conference registration

- One-page flyer for conference registration desk

- Pull-up banner at Networking Breakfast (sponsor provides banner)

- Recognition as Sponsor during event opening and logo displayed on event PowerPoint slide

- Logo included on conference website, registration page and confirmation email

- Logo included on all email promotion pre- and post-event

- Registration list with contact details (name, company, title, email) pre- and post-event

Coffee Breaks – 1 Available

- 1 complimentary conference registration

- One-page flyer for conference registration desk

- Pull-up banner displayed during break (sponsor provides banner)

- Recognition as Sponsor during event opening and logo displayed on event PowerPoint slide

- Logo included on conference website, registration page and confirmation email

- Logo included on all email promotion pre- and post-event

- Registration list with contact details (name, company, title, email) pre- and post-event

Additional Sponsorship Opportunities

Conference Wi-Fi – Available

- Sponsor logo on WiFi password cards provided to all attendees

- 1 complimentary conference registration

- Pull-up banner in registration area (sponsor provides banner)

- One-page flyer for conference registration desk

- Recognition as WiFi Sponsor during event opening and logo displayed on event PowerPoint slide

- Logo included on conference website, registration page and confirmation email

- Logo included on all email promotion pre- and post-event

- Registration list with contact details (name, company, title, email) pre- and post-event

Solution Provider Demos – 4 Available

- 25-minute session for organization to display thought leadership role on a relevant industry topic (sponsor provides speaker(s) and topic)

- 1 complimentary conference registration

- One-page flyer/insert for conference registration desk

- Recognition as Demo Sponsor during event opening and logo displayed on event PowerPoint slide

- Logo included on conference website, registration page and confirmation email

- Logo included on all email promotion pre- and post-event

- Registration list with contact details (name, company, title, email) pre- and post-event

Conference Q&A – SOLD OUT

- Sponsor logo on S.lido password cards provided to all attendees

- 1 complimentary conference registration

- Recognition as Sponsor during event opening and logo displayed on event PowerPoint slide

- Logo included on conference website, registration page and confirmation email

- Logo included on all email promotion pre- and post-event

- Registration list with contact details (name, company, title, email) pre- and post-event

Conference Notepads – Available

- Sponsor supplies logo conference notepads

- 1 complimentary conference registration

- Recognition as Sponsor during event opening and logo displayed on event PowerPoint slide

- Logo included on conference website, registration page and confirmation email

- Logo included on all email promotion pre- and post-event

- Registration list with contact details (name, company, title, email) pre- and post-event

Table-Top Display – 4 Available

- Table-top display (sponsor provides branded tablecloth)

- 1 complimentary conference registration

- Recognition as Sponsor during event opening and logo displayed on event PowerPoint slide

- Logo included on conference website, registration page and confirmation email

- Logo included on all email promotion pre- and post-event

- Registration list with contact details (name, company, title, email) pre- and post-event

Conference Bags – Available

- Sponsor supplies logo bags

- 1 complimentary conference registration

- Recognition as Sponsor during event opening and logo displayed on event PowerPoint slide

- Logo included on conference website, registration page and confirmation email

- Logo included on all email promotion pre- and post-event

- Registration list with contact details (name, company, title, email) pre- and post-event

Conference Lanyards – Available

- Sponsor supplies logo lanyards

- 1 complimentary in-person conference registration

- Recognition as Sponsor during event opening and logo displayed on event PowerPoint slide

- Logo included on conference website, registration page and confirmation email

- Logo included on all email promotion pre- and post-event

- Registration list with contact details (name, company, title, email) pre- and post-event

Interested in sponsoring the 2025 Europe Bank to Bank Forum?

For more information, please contact:

Matthew Kaitz

Director, Business Development

[email protected]

+1 (703) 200-9071

Events App FAQ

How do I access the BAFT Events App?

Download the app from Google Play or Apple App Store. Search for BAFT Events. Once you download the app, click on 2025 BAFT Europe Bank to Bank Forum. Enter your first/last name and the email used to register for the conference. A verification code will be sent to your email address shortly to access the conference app.

My institution restricts downloading apps to my work phone or computer. How can I use the app/event platform?

You can use the web version instead of the event app. Go to https://cvent.me/944qbk. A verification code will be sent to the email you used at registration.

I didn’t receive my verification code. Who do I contact?

Your verification code is sent to the email address you used when you registered for the conference. If you didn’t receive your code, please check your spam folder. If you still don’t see your verification code email, please contact [email protected] or stop by the BAFT registration table in the foyer of the Hilton Ballroom.

How do I schedule meeting appointments via the app?

- Click the Schedule bilateral meetings from the app or website homepage

- Search the attendee name you want to meet with

- Click the calendar icon to the right (if using the web version) or below the attendee name (if using the app)

4. Select the appointment time and add any additional details, then send the meeting invitation.

Watch the short tutorial

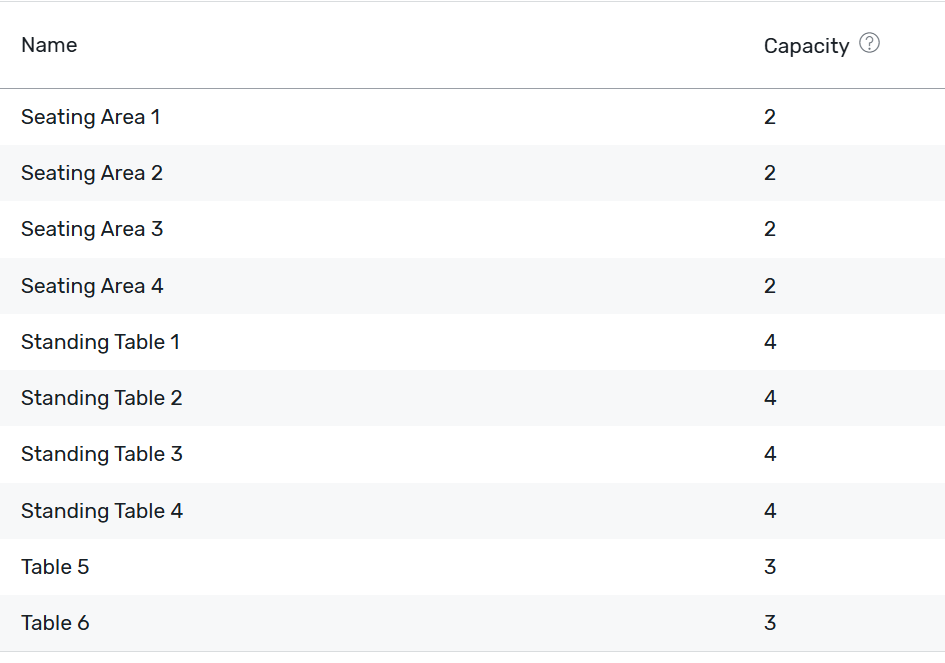

How do I reserve a table at the BAFT Lounge? When your meeting invitation is accepted, a table will automatically be assigned to you. Please check in at Orange 4 about 5 minutes before your meeting starts and remember to please end on time for others to use your table. Table reservations are up to 30 minutes long.

How many meeting attendees can I invite to the BAFT Lounge?

Table reservations are available for up to 4 attendees (including the meeting host) at a time. Please see the maximum capacity per table available to reserve. The app will automatically assign a table based on availability and number of meeting attendees.

How do I know if my meeting is accepted?

You will receive a notification when your meeting invite is accepted, and the meeting will display with your table assignment under My Schedule.

How does an attendee get notified of a meeting request?

The attendee will receive a notification via the app. Please make sure to accept notifications when you first sign in to the app.

Venue & Accommodations

Conference Venue

The 2025 BAFT Europe Bank to Bank Forum will be held March 10 – 12 at the Hilton Hotel in Amsterdam, Netherlands. Known as the site of John and Yoko’s ‘bed-in’ protest, our canal-side hotel is in one of the city’s quieter neighborhoods. We’re one km from the Museumplein, home to the Rijksmuseum and Van Gogh Museum, and our bike rentals make exploring easy.

Hilton Amsterdam

Apollolaan 138

Amsterdam, 1077 BG

Netherlands

Room Accommodations

The BAFT Europe Bank to Bank Forum will be held at the Hilton Amsterdam, Apollolaan 138, 1077 BG Amsterdam, Netherlands. More information can be found on their website Hilton Amsterdam.

BAFT Room Block Now Sold Out

At this time the BAFT block of guestrooms is fully booked. Please check on Hilton.com to see if guestrooms are available at the current prevailing rate. If you would like to modify a room booked into the BAFT block and are unable to do so, please contact [email protected] for answers.

There is a hotel nearby Bilderberg.nl, where you can also check availability at the prevailing rate.

We look forward to seeing you in Amsterdam! – the BAFT Events Team [email protected]

Testimonials

“I really liked the atmosphere, and the opportunity to network, but what I liked the most is that all the topics were presented in a very practical manner. Often when I attend such events, i feel I am being lectured but this was the one event where I felt like there is a genuine discussion on topics that impact our day to day working lives, in addition to learning about the newest issues, trends, opportunities and threats.”

Forum Attendee

Amman, Jordan

“Overall, the BAFT conferences are very productive as you can meet many clients at the same time and in a smaller environment compared to other conferences. ”

Forum Attendee

Manama, Bahrain

“The Forum is very well organized with interesting topics related to transaction banking and very experience speakers. It's also a great opportunity for networking with industry talents and experts across different organizations.”

Forum Attendee

Singapore

“It was very well organized and I especially enjoyed meeting people from diverse backgrounds.”

Forum Attendee

Los Angeles, USA

“Very good platform to meet clients/relationship/prospective clients. Content of the session was good.”

Forum Attendee

London, UK

“BAFT events are always top quality and attended by senior transaction bankers.”

Forum Attendee

Brussels, Belgium

Sponsors

Interested in sponsoring the 2025 Europe Bank to Bank Forum? We can tailor your sponsorship package to meet your goals.

To discuss your sponsorship options, please contact:

Matthew Kaitz

Director, Business Development

[email protected]

+1 (703) 200-9071